يَـٰٓأَيُّهَا ٱلنَّاسُ كُلُوا۟ مِمَّا فِى ٱلْأَرْضِ حَلَـٰلًۭا طَيِّبًۭا وَلَا تَتَّبِعُوا۟ خُطُوَٰتِ ٱلشَّيْطَـٰنِ ۚ إِنَّهُۥ لَكُمْ عَدُوٌّۭ مُّبِينٌ - Surah Al-Baqarah [2:168]

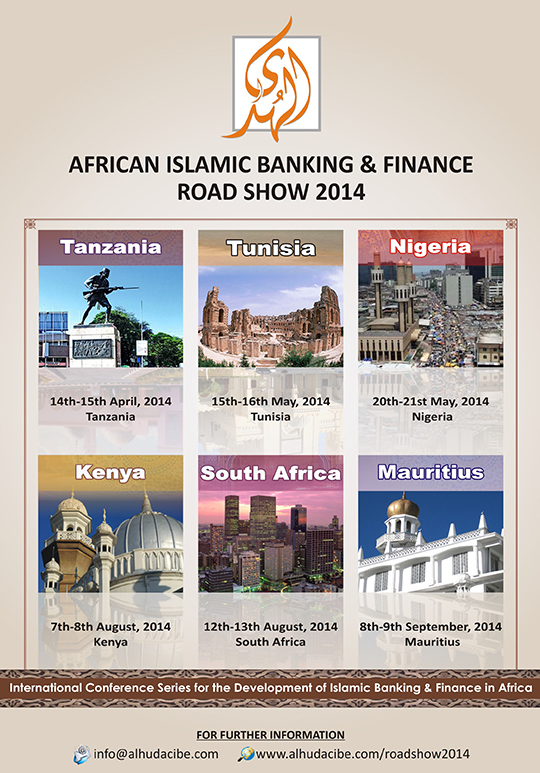

| AlHuda CIBE will Organize African Islamic Banking and Finance Road Show |

| Int’l conferences will be organized in Tanzania, Tunisia, Nigeria, Kenya, Ghana, South Africa and Mauritius during the Road show |

|

| (Lahore): AlHuda Centre of Islamic Banking and Economics (CIBE) is committed to hold an International Road Show on Islamic Banking and Finance that will be started from April 2014 form Tanzania and will successfully be ended by September 2014 in Mauritius by organizing Int’l conferences on Islamic Banking and Finance in seven (07) African countries during this entire road show so that African region could progress by taking benefit from the practices of international Islamic banking. Besides Islamic banking and finance, Takaful, Sukuk, Islamic Funds, Islamic Microfinance and various other relevant topics would be discussed during the programs.

Addressing to the announcing ceremony of the Road Show, Muhammad Zubair Mughal, Chief Executive Officer, AlHuda CIBE said that Islamic banking and finance is rapidly increasing all over the world and its assets would reach to 2 trillion dollars by the end of 2014. But unfortunately, the development of Islamic banking and finance is very slow in the entire African region while the 54 African countries could rapidly progress by implementing Islamic finance and Sukuk. The dilemma of African countries is mainly poverty and it could also be overcome through the implementation of Islamic mode of banking and finance in the region where almost 50% population is Muslim while Muslims and non-Muslims both can take benefit of Islamic banking and finance. While giving reference of Islamic banking and finance in Africa, he further added that there are various countries of Africa where serious efforts are observed for the development and promotion of Islamic banking and finance i.e. Sudan, Tunisia, Egypt, Morocco South Africa and Nigeria while there are a few countries that are taking rapid initiatives towards Islamic banking like Kenya, Mauritius, Libya, Ghana and Senegal. Current economic conditions have further highlighted the need of Islamic banking and finance and African region would definitely take advantages of it. He further said that besides the promotion of Islamic banking and finance, the purpose of the road show is also to acknowledge the need of giving hype to the system beyond any political and religious refrains. Specialized training workshops on various relevant topics will also be part of the international conferences like Takaful workshop in Tanzania, Sukuk workshop in Tunisia, Islamic Microfinance in Nigeria, Sukuk in South Africa, Takaful workshop in Mauritius. The core objective of the entire program is to strengthen the foundations of Islamic banking and finance in African region to give back to the progress of Islamic mode of banking and finance there. It is to be noted that AlHuda Centre of Islamic Banking and Economics is an international organization working for the promotion of Islamic banking and finance that is working for education, trainings, advisory and consultancy. For further details: www.alhudacibe.com. |

| Halal Soap |

| Muhammad Zubair Mughal zubair.mughal@halalrc.org |

| The relation between soap and human is as old as the history of culture. Soap has always been the part of civilized society in different shapes either in the shape of Soil collection or mixture of tree leaves and vegetables or mixture of ash and oils while, presently, it comes up with the unique blend of various chemical components, as it is known as liquid soap, beauty soap, toilet soaps and antibacterial soaps etc which is the dire need of each house. As per a careful estimate, about 6 billion people of the world use soap daily and this number is prominently increasing day by day.

But current chemical components and scientific developments have raised differnt questions about the Halal authenticity of soap and have evidently proved the involvement of non Halal ingredients i.e. Tallow extracted from the fat of swine, chemical from the haram animals’ flow “Satiric Acid” which is obtained from Lards and all this mixture and blending have distinguished between the division of Halal and haram. While in Islam the matter of Halal and Haram is not only confined to foods rather it is also applied on services (Islamic Banking, Islamic mode of businesses and Islamic Finance etc), clothes and tangible items such as Cosmetics, Soap and Paint etc. When man enters in the category of impurity by touching some haram animals and it becomes mandatory to have shower (Ghusal), then now would it be justified to take bath while using the soaps which is produced with chemicals from the ingredients obtained from same animals? Will his worship be accepted after using that soap? Hence, it is needed that we should discriminate Halal and Haram in tangible (consumable) items along with food and services. We buy and adopt with joy the leather made imported items such as shoes and hand bags imported from Italy and other countries but do we ever think of the ingredients used in those products and the skin of the animal which was used in those products? Whether the Halal animals are utilized in those countries? If “No” then which animal’s skin was used as leather? Which chemicals are used in dying processing of towel that we use to clean the face. Is it obtained from swine’s Fat? Which chemicals are used in our paint industry etc? These are the matters of deep concentration that I leave on the readers who need to make the efforts to avoid haram a part of our life. The prime objective of this piece of writing is not to put the Muslims into the fear rather to highlight the issues caused by latest chemical evolutions. If we analyze the current volume of cosmetics industry glogally which is about US $ 335 billion but share of Halal cosmetics is US $ 13 billion while our, Muslim, population is about 1.6 billion which is the 26% of whole world population, so, as per these figures, non-Halal cosmetics have more consumption in Muslim countries and the main reason behind it is the lack of awareness and no discrimination between Halal and haram in material items. May Allah (Subhana wa’a Taala’a) forgive us for the sins caused by lack of awareness and give us enough strength to avoid them in future (Aameen). Halal Research Council (HRC), keeping in view the social, religious and professional responsibilities, inaugurated a specialized department for state of the art research in Soaps, Cosmetics, Dyeing and Paint Chemical to resolve the problems in these industries through in depth research to give a clean and purified society to the Muslim world. |

| Arab countries can alleviate poverty through Islamic microfinance |

| Poverty can be reduced in Arab countries by taking Jordan as a regional hub of Islamic microfinance |

| 21-01-2014 |

|

| (Amman – Jordan) Poverty is increasing rapidly in the Arab countries which are blessed with surplus of mineral and oil resources, one of the reasons is absence of financial products for poverty alleviation which are compatible with their religious, cultural and social values and beliefs While through Islamic microfinance poverty can be controlled over and poor can be brought into the financial inclusion in Arab countries. These views expressed by Muhammad Zubair Mughal, Chief Executive Officer - AlHuda Centre of Islamic Banking and Economics (CIBE) in an international workshop on Islamic Microfinance jointly organized by AlHuda CIBE and Arab Student Aid International in Amman - Jordan. To discuss the current status of poverty in Arab World, he said that poverty is increasing rapidly in Syria, Iraq, Libya, Egypt, Yemen and Tunisia as the consequence of Arab Springs while poverty already exists in Sudan, Somalia and other Arab countries which can be addressed effectively through Islamic Microfinance as it quite suited to their religious beliefs. He, presenting the poverty index in Arab countries, evidenced the substantial existence of poverty in Arab countries including Iraq by 23%, Iran 18%, Yemen 35.8%, Jordan 13.5% and Lebanon 28% etc. He said that if we look into the geographical location of Jordan it seems to be surrounded by the conflict zones including the neighboring countries like Syria, Iraq, Palestine and Lebanon. While Micro enterprise development, educational development, refugees issues and job creation can be enhanced quickly through Jordan taking as regional hub for Islamic microfinance. Addressing to the event, Ameera Yaaqbeh Hilal, Executive Director – Arab Student Aid International, said that Islamic microfinance is the critical need of time through which poverty can be alleviated from society by providing Shariah compliant loans to the students and enhancing their vocational capabilities. She also announced to establish the first Islamic microfinance institution in Jordan by utilizing AlHuda CIBE expertise and technical assistance. |

| 2014 will be promising for Islamic Finance Industry |

| Islamic finance volume will be reaching at US $ 2 trillion with having 78% share of Islamic banking, 16% Sukuk, 1% Takaful, 4% Islamic funds and 1% Islamic Microfinance: Zubair Mughal |

| 31-12-2013 |

| (Lahore) Islamic finance will grow with rapid pace in the year 2014 and its volume will pass through US $ 2 trillion where Islamic banking keeps 78%, Sukuk 16%, Takaful 1%, Islamic Funds 4% and Islamic Microfinance has 1% share in the Islamic Finance industry. In the year 2014, Dubai and London will be in competition to be the global hub of Islamic Banking and Finance while Kuala Lumpur will also attempt to be in this contest but the Islamic finance industry can be grown more through synergizing approach and alliance with industry stakeholders rather than setting any competition. These views were expressed by Islamic Finance expert, Mr. Muhammad Zubair Mughal, CEO - AlHuda Centre of Islamic Banking and Economics (CIBE) during an analysis on Islamic finance industry in the beginning of year 2014. He said that the Islamic finance industry growth will go on double digit in 2014 which will turn the US $ 1.6 trillion volume of Islamic finance industry in December 2013 to US $ 2 trillion by the end of 2014 including North African countries (Tunisia, Libya, Morocco, Senegal and Mauritania etc), rising trends of Islamic finance in Europe and UK, also the rising and substantial share of international market of Sukuk shall contribute to it. It is anticipated that India and China may step towards the Islamic finance in 2014 where more than 200 million Muslim populations are in search of a compatible financial system with their religious beliefs and thoughts. He said there is no doubt that international financial crisis will not hit the Islamic finance industry but due to the Arab Spring, Islamic finance industry has faced recession in some countries of MENA but there are chances of their revival in 2014. He, giving an analysis, said that Sukuk will grow rapidly in 2014 and Muslim countries including non-Muslim countries e.g UK, China, South Africa and Europe etc will also get benefit from it which will enhance the growth in Islamic finance industry but Takaful Industry is not supposed to have any substantial breakthrough. It is being hoped that 2014 will prove better period for Islamic Microfinance industry as different international institutions including Islamic Development Bank (IDB) have declared it a potential tool for poverty alleviation around the globe. He also added that Islamic finance industry may face recession in certain countries including Indonesia while in Nigeria and Tunisia it may face some problems on religious and political grounds. He said that the Islamic finance initiatives in America and Canada including Latin American countries (Brazil, Argentina and others) have been taken and it is hoped that Islamic Funds market will come into existence in these regions by the year 2014. |

| Tunisia has big potential for Islamic Finance: Zubair Mughal |

| Tunisia would be the global hub of Islamic Finance for French speaking countries |

| 16th December, 13 |

| There are big opportunities to promote Islamic finance in Tunisia which can be the global hub of Islamic Finance for French speaking countries, said by Muhammad Zubair Mughal, Chief Executive Officer - AlHuda Centre of Islamic Banking and Economics (CIBE) in an international conference on “Finance and Enterprise” jointly organized by World Bank, International Monetary Fund (IMF), International Finance Corporation (IFC) and European Bank for Reconstruction and Development in Sousse – Tunisia, which was attended by the Prime Minister of Tunisia including many government ministers, heads and senior delegates from Central Banks, World Bank, IMF, IFC, European Bank and other dignitaries from different international organizations. Muhammad Zubair Mughal, being the guest of honor, during his address stated that international financial crisis can be addressed in a better way through Islamic Finance and such financial crisis could have not been happened if Islamic financial system was followed and implemented at that time, he said there are about 2000 Islamic Financial Institutions working globally as Islamic Banks, Takaful ( Islamic Insurance), Sukuk ( Islamic Bonds), Islamic Fund and Islamic Microfinance institutions etc in more than 100 countries and fortunately no Islamic Financial institution was effected by such global financial crisis which ensures the strength and rationality behind the Islamic financial system. He also added that international institutions such as Islamic Development Bank (IDB), Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI), Islamic Financial Services Board (IFSB) and International Islamic Liquidity Management (IILM) are dedicatedly working for Islamic finance around the globe which will further promote and strengthen the Islamic finance in future globally. He, responding to a question related to the relationship between religion and Islamic finance in question answer session, said that Islamic banking and finance is a name of a system not religion so all other religions can get benefit from it and that is why Islamic banking and finance is growing in the western world while non Muslims are utilizing the Islamic financial products, considerably, to fulfill their business, personal and financial needs as in only America which has more than 20 Islamic financial institutions are working, which are actively providing the Islamic financial services to fulfill the financial needs of Muslims and non-Muslims equally. During his stay in Tunisia, he met with Dr. Amel Amri, President – Tunisian Association for Islamic Finance (TAIF), Dr. Raza, President – Islamic Economic Association Tunisia and heads of some other Islamic financial institutions. He said that Tunisia has a good recognition in Islamic financial industry having 2 full-fledged Islamic banks, Takaful companies, universities with having Islamic finance program, Sukuk Laws and some other similar institutions which are indicating the best future of Islamic finance in Tunisia but he, realizing the need of Islamic microfinance, said that Islamic microfinance is missing component of Islamic finance in Tunisia while socioeconomic development and poverty reduction can be done in better way through Islamic microfinance in Tunisia. |

| A New Venture Established to Strengthen Islamic Finance in France and USA |

| 2nd December, 13 |

| (Dubai - UAE) A Memorandum of Understanding (MOU) has been signed between Al Huda Center of Islamic Banking and Economics (CIBE) and Franco-American Alliance for Islamic Finance (FAAIF) to cooperate in the development of Islamic banking and finance in France and the United States. Both parties agreed to work together, leveraging their different areas of regional and professional expertise of Islamic finance and synergizing their skills for the broader goal of promoting and developing Islamic finance worldwide, especially in the Franco – American region. MOU Signing Ceremony held in Dubai, United Arab Emirates today, in which Muhammad Zubair Mughal, Chief Executive Officer of Al Huda CIBE and Camille Paldi, Chief Executive Officer of FAAIF signed the agreement. During the media briefing, Camille Paldi mentioned that she is excited to bring Islamic financial services, training, and expertise to her home country the United States after having spent many years’ education & training abroad in Islamic finance, law, and Shari'ah. With her strong knowledge of Islamic banking, finance, Shari'ah, and law, Paldi hopes to impact the financial services sector in the USA, helping to boost the economy and steer the nation in a new direction. Paldi is excited to utilize her international network to help achieve this purpose, starting with this MOU with AlHuda CIBE. While discussing the importance of this MOU, CEO of AlHuda CIBE, Zubair Mughal said that this is the right time to introduce Islamic financial solutions to the Western world so that they may explore the option of solving financial dilemmas and crises with Islamic financial instruments, derived from the Holy Book. Zubair said that AlHuda CIBE will extend their scope of services in European and American markets through the help of FAAIF. He also mentioned that AlHuda's services in these regions would include Islamic finance product Development services, sukuk structuring, Takaful development, and Shari'ah advisory. He also mentioned that Alhuda CIBE already has a very strong professional network in Central Asia, the Middle East, and African regions, but through this MOU, Moghul plans to extend their scope in the American markets as well. AlHuda CIBE is a well-established brand in the international Islamic finance and banking industry focusing on Advisory, Consulting, Capacity, and Shariah Advisory services, while FAAIF is an emerging Alliance of Franco – American financial experts, which is headed by renowned legal and Islamic financial expert Camille Paldi. |

| Islamic Microfinance should be Introduced Internationally: Dr. Fatima Al-Blooshi |

| Three days’ 3rd Global Islamic Microfinance Forum ended in Dubai with a declaration to put joint efforts for the poverty alleviation |

| 10-10-2013 |

| (Dubai) Islamic Microfinance is an effective tool for the poverty alleviation and it should be introduced around the globe to state an effective policy for ultimate poverty alleviation from the world, these views were stated by Dr. Fatima Mohamed Yousif Al-Balooshi, Minister (Ministry of Social Development – Bahrain) as a Chief Guest in the 3rd Global Islamic Microfinance Forum (GIMF) held on 6th to 8th October, 2013 at Dusit Thani Hotel, Dubai in which delegates from more than 30 countries participated actively and this Forum was organized and conducted by AlHuda Centre of Islamic Banking and Economics (CIBE). She also added that Islamic Microfinance should be presided and supported by the Government in different countries of the world to promote the Islamic Microfinance Institutions. She also admired the endeavors of AlHuda CIBE at the inauguration of 3rd Global Islamic Microfinance Forum on 6th Oct, 2013 and also proposed to conduct the 4th Global Islamic Microfinance Forum in Bahrain. Muhammad Zubair Mughal (CEO – AlHuda CIBE), addressing to the Forum, said that Poverty is increasing in the Muslim countries rapidly and consequently the half of the world poverty has, approximately, been confined to the Muslim countries in the current age. The involvement of interest in micro financing is one of the major causes behind this phenomenon and that is why Muslims hesitate to avail microfinance facility. If Islamic Microfinance is not introduced resolving this issue, the world’s poverty will increase extraordinarily. He said that the forum aimed at gathering all the Islamic Microfinance Institutions at single platform, to streamline the policies for poverty reduction, to promote the Research and Education in Islamic Microfinance industry and to enhance its outreach on global canvas. He said that current facts to the failure of microfinance system require an alternative and prudent Islamic Microfinance system to the world to enhance the financial inclusion globally and ultimate global economic prosperity. Addressing to the forum Mr. Mr. Hamdan Mohamed Al Murshidi (President & Chairman of the Board, Arab Business Club, United Arab Emirates) said that there is no other argument to address poverty through Islamic Microfinance as it is the ultimate solution to this problem and also he committed with his reward less services to promote Islamic Microfinance globally. While Mr. Amjad Saqib (Executive Director – Akhuwat) said that Islamic Microfinance is a Hope for the Poor which they (poor) are looking forward to resolve their Social and Economic problems, so Islamic Microfinance should be promoted globally. He, by presenting Akhuwat as a case study, figured out that there are about 380000 families benefitting through Qarz e Hasana from Akhuwat. Meanwhile its portfolio has crossed PKR. 5 billion with an increasing trend day by day. The forum was attended by Researchers, Scholars and Islamic Microfinance practitioners including: Justice (R) Khalil Ur Rehman (Shariah Advisor – AlBaraka Islamic Bank, Chairmen – Punjab Halal Development Agency – Govt. of Pakistan), Mufti Aziz Ur Rehman (Manager-Shariah, Mawarid Finance – Dubai), Dr. Ajaz Ahmed Khan (Microfinance Advisor, CARE International UK), Mr. Atef Ebrahim (Chief Executive Officer, Family Bank - Bahrain), Mr. Zeinoul Abedien Cajee (Founding CEO/ Management Board, National Awqaf Foundation of South Africa), Mr. Mamode Raffick Nabee Mohomed (Founder/ Secretary, Al Barakah Multi-purpose Co-operative Society Limited – Mauritius), Ms. Rehab Lootah (Managing Director - Mawarid Consultancy Dubai - U.A.E), Mr. Mohamed El Mehdi Zidani (Author - An Islamic Analysis of the Grameen Bank and Director Baraka Editions – France), Mr. Pervez Nasim (Chairmen & CEO, Ansar Financial and Development Corporation – Canada), Mr. Abdul Samad (Shariah Advisor, The Bank of Khyber – Pakistan), Mr. Humayun Saeed Jamshed (Senior Director - Islamic Banking & Finance, SAB – France), Mrs. Thamina Anwar (Founder and CEO, Awqaf New Zealand Mrs. Helena Lutege (Founder and Managing Director, BELITA Fund – Tanzania), Mr. Ali Tariq (Executive Director, Iraqi Microfinance Network – Iraq), Dr. Mohammed Kroessin (Global Microfinance Advisor – UK), Mufti Barkatulla (Sharia Advisor, Islamic Bank of Britain, London, UK) and some other prestigious international speakers addressed in this forum. |

| The Global Islamic Microfinance Forum Ready to Set New Standards |

| The Forum will determine the Standards and strategic policies for Sustainable Islamic Microfinance Development. |

| September 19, 2013 |

(Pakistan) The Global Islamic Microfinance Forum on Islamic Microfinance is going to be held in U.A.E on 6th October, 2013 in which the delegates of more than 30 countries are expected. The purpose of Forum is to introduce Islamic Microfinance in the global canvas as an effective tool for poverty alleviation and Social development, to set its standards, to develop Islamic Microfinance internationally and to have dialogue with International Donor/Development agencies for sustainable development. Two days specialized workshop is being arranged after the forum in which the Shari’ah standards and marketing strategies to develop, operate and sustain Islamic Microfinance Institutions will be discussed. It should be noted that this forum is being jointly arranged by AlHuda Centre of Islamic Banking and Economics (CIBE) and Akhuwat. Akhuwat is a Pakistan based institute which has distributed US $ 47.65 million amongst 300,000 families via Islamic Microfinance. (Pakistan) The Global Islamic Microfinance Forum on Islamic Microfinance is going to be held in U.A.E on 6th October, 2013 in which the delegates of more than 30 countries are expected. The purpose of Forum is to introduce Islamic Microfinance in the global canvas as an effective tool for poverty alleviation and Social development, to set its standards, to develop Islamic Microfinance internationally and to have dialogue with International Donor/Development agencies for sustainable development. Two days specialized workshop is being arranged after the forum in which the Shari’ah standards and marketing strategies to develop, operate and sustain Islamic Microfinance Institutions will be discussed. It should be noted that this forum is being jointly arranged by AlHuda Centre of Islamic Banking and Economics (CIBE) and Akhuwat. Akhuwat is a Pakistan based institute which has distributed US $ 47.65 million amongst 300,000 families via Islamic Microfinance.Executive Director of Akhuwat, Mr. Amjad Saqib said that through this Forum, Islamic Microfinance will be introduced as a sustainable system around the world so that Islamic Microfinance could be properly utilized in order to take the world out of the darkness of poverty. While briefing about the purpose and aims of this Forum, Chief Executive Officer of AlHuda Centre of Islamic Banking and Economics, Mr. Muhammad Zubair Mughal said that poverty is going up due to the failure of present microfinance system whereas in order to solve this problem, whole world is looking towards Islamic Microfinance. He said that if Islamic Microfinance is not included in the strategies for alleviating poverty then the achievement of Millennium Development Goals (MDGs) of United Nations would become so difficult because Muslims are 46% of World’s total poverty and United Nations has added 26 countries from the 57 Countries of OIC among the Least Developed Countries. So, Islamic Microfinance is mandatory in order to alleviate poverty from the Muslim Countries because Muslims avoid Conventional Microfinance due to the factor of interest, as Interest is strictly prohibited in Islamic that is way Interest is an important reason for the poverty in Muslim Countries. He also added that current facts and figures, as per the latest report of poverty reduction in India, China and other countries, are showing that poverty in Muslim countries is increasing day by day while in non Muslim countries it is decreasing constantly. It is worth to mentioning that Islamic Microfinance is a system, it is not a religion rather it can be utilized/operated by both Muslims and Non-Muslims for social development & poverty alleviation. He further said that now the time has come that the International Organizations like UN, ADB, IFC, USAID, GIZ, DIFD, and IFAD etc. have to play their role to alleviate poverty from the world by including Islamic Microfinance in the strategies to reduce poverty. He said that Islamic Microfinance has more characteristics to alleviate poverty in comparison with Conventional Microfinance and it can be easily integrated with all the models of Microfinance like Grameen Model, Village Banking Model, Co-operative Model and Self Help Group Model etc. So in order to introduce Islamic Microfinance in the world, very fewer changes would be needed to make in Microfinance industry. He also added that in Global Forum the Islamic Microfinance related models i.e. Qarz-e-Hasana, Waqf, Islamic Commercial Microfinance, Zakat, BMT’s and some other Islamic approaches to alleviate poverty will be discussed in detail. Forum shall last for 3 days in Dubai, at the end of which, a declaration will be issued while Dr. Fatima Mohammed Yousif Al-Balooshi (Minister of Social Development Kingdom of Bahrain) will be the Guest of Honor of the Forum and with some other distinguished speakers such as: Mufti Barkatulla (Shariah Advisor- Islamic Bank of Britain), Mr. Mohammed Kroessin (Global Microfinance Advisor – IRF World Wide, UK), Dr. Ajaz Ahmed Khan (Microfinance Advisor – Care International, UK), Mr. Zaigham Mehmood Rizvi (Renowned International Expert of Islamic Banking and Housing Finance - Washington, USA), Mr. Zeinoul Abedien Cajee (Founding CEO/Management Board – National Awqaf Foundation of South Africa), Mr. Mahesh (CEO – Umex Securities, UK), Mr. Saleem Ranjha (Director Akhuwat, Pakistan), Mufti Aziz Ur Rehman (Manager Shariah - Mawarid Finance, Dubai), Ms. Thamina Anwar (Founder and CEO Awqaf New Zealand), Mr. Atef Ebrahim (CEO – Family Bank, Bahrain), Mr. Mohamed El Mehdi Zidani (Director Baraka Editions, France), Justice Retired Khalil Ur Rehman (Shariah Advisor – AlBaraka Islamic Bank, Chairman Punjab Halal Development Agency, Government of Pakistan) and some Industry Specialists and Researchers from 15 countries will add value to the event with their participation. For further details, please visit: www.alhudacibe.com/imfc2013 |

| A Big Question Mark on Islamic Finance Industry |

| Muhammad Zubair Mughal - zubair.mughal@alhudacibe.com |

Apparently, it is a matter of pleasure that global volume of Islamic Finance Industry has crossed $ 1.3 Trillion approximately, which is, definitely, providing the best and compatible sources of finance with interest free modes. According to a careful estimate, there are more than 2000 Islamic Financial Institutions are offering Islamic Banking, Islamic Insurance (Takaful), Islamic Funds, Mudaraba, Islamic Bonds (Sukuk), Islamic Microfinance and some other institutions actively providing Islamic financial services on different modes in adherence of Shari’ah principles of Islamic Finance. If we look into the market share of above mentioned institutions, we get shocked and depressed for a while with the fact that Islamic Banking and Finance has been nearly confined to the rich people and as per the ideology of capitalism, the profit urge has captured the Islamic Financial Industry and discriminated the underprivileged people and letting them deprived from Islamic financial services. Keeping in view these facts, it should be said as the commercialism has captured Islamic Finance institutions in such a way that business with and financing to the poor has gone astray from their agenda. Apparently, it is a matter of pleasure that global volume of Islamic Finance Industry has crossed $ 1.3 Trillion approximately, which is, definitely, providing the best and compatible sources of finance with interest free modes. According to a careful estimate, there are more than 2000 Islamic Financial Institutions are offering Islamic Banking, Islamic Insurance (Takaful), Islamic Funds, Mudaraba, Islamic Bonds (Sukuk), Islamic Microfinance and some other institutions actively providing Islamic financial services on different modes in adherence of Shari’ah principles of Islamic Finance. If we look into the market share of above mentioned institutions, we get shocked and depressed for a while with the fact that Islamic Banking and Finance has been nearly confined to the rich people and as per the ideology of capitalism, the profit urge has captured the Islamic Financial Industry and discriminated the underprivileged people and letting them deprived from Islamic financial services. Keeping in view these facts, it should be said as the commercialism has captured Islamic Finance institutions in such a way that business with and financing to the poor has gone astray from their agenda. According to the facts and figures (March-2013) by Consultative Group to Assist the Poor (CGAP), (an associated institution to the World Bank), the global volume of Islamic Microfinance has reached at USD 800 million with serving about 1.3 million beneficiaries. While as per the latest research (July-2013) conducted by AlHuda Centre of Excellence in Islamic Microfinance, the global volume of Islamic Microfinance has reached at $ 1 billion. Total number of Islamic Microfinance Institutions is more than 300, operating around the globe while the share of Islamic Microfinance is less than 1% from the overall volume of $ 1.3 trillion of Islamic Finance Industry, which, itself, is a big question mark on Islamic finance industry and proving its misfortune. These stated facts and figures give rise to different question such as: is social segmentation between poor and rich 1% : 99% ? Does Islamic Finance have financial resources only for the rich people? Not for the Poor? Is Islamic Finance an option only for the particular segment of society? Is it justice system of Islam? etc, whereas the answers to all these questions are in negative and awful, definitely. As per the analysis of Islamic Finance in the light of Islamic teachings, we get into, the Islamic ideology of finance which aims at justice, cooperation, welfare of the poor and financially deprived people of society with its best principles. Islam is a name of revolution starting from poor and will ending at same. If we have a look at comparative study of different religions regarding the view point of poverty, then we come to know that poverty alleviation is not only the social responsibility in Islam rather a religious obligation as well. Zakat, Charity, Sadqa, Fitr, Usher and Qarz-e-Hasan etc are amongst the key religious responsibilities of Muslims, whereas it is a social responsibility in other religions rather than a religious one which recognized as branded name of “Corporate Social Responsibility” (CSR), and they doing good work for poverty alleviation and social development in the whole world, but unfortunately, Islamic Financial Industry have ignored its social or religious responsibilities. If we look at the world poverty, we get surprising facts and figures. The 46% of whole world poverty exists in Muslim World while Muslim population in the world is 26%. United Nations have marked 26 out of 57 member countries of OIC, as the least developed countries. Current statistical information is highlighting that the poverty in the Muslim World is increasing day by day which is, as per the serious observation, caused by none or least response of poor people to Microfinance facilities because of interest, none or limited Islamic Micro Financing facilities provided by Islamic Financial Institutions and the least attention and interest of International Donor Agencies (UNDP, World Bank, IFC) towards Islamic Microfinance which, in return, is throwing the Muslim world into an era of poverty. As per the praiseworthy analysis of economics experts of modern age (Mr. Tariq Ullah and Mr. Ubaid Ullah 2008), 650 million Muslims in the world are living below poverty line with less than $ 2/ per day income. While on the other hand, only the 1.3 million Muslims out of 650 million were tried to get them out of poverty through Islamic Microfinance services whereas remaining 649 million Muslim, living in poverty, are still looking forward any financial assistance through Islamic way. Islamic Finance Industry is facing lot of criticism in different aspects e.g. acceptability of Islamic Finance, objections from Shari’ah Scholars, Conflicts in Shari’ah related issues etc are the main challenges to Islamic Finance Industry. But objection to neglect the poor is very critical, once not resolved, can damage and bring a perpetual loss to the Islamic Banking and Finance Industry. The optimal results for the economic prosperity of Islamic Finance can be ensured if Islamic Microfinance Institutions established by the Islamic Finance Industry. Although Islamic Microfinance can be energized by utilizing available charity amount of Islamic Banking and Finance industry which is worth in Million Dollars. Inter alia Zakat, Sadqaat, Waqf, other Islamic Microfinance products e.g Murabaha, Musharaka, Salam and Istisna etc can be used prolifically for poverty reduction and social development. Our Shari’ah scholars are also responsible for insisting and pursuing the Islamic Financial Institutions to execute and promote Islamic Microfinance otherwise there is a definite chance of rumors that Islamic Banking and Finance services are only for rich people making discrimination of “Do Have and Have Not” and ensuring its ultimate benefits only to rich people. ( Muhammad Zubair Mughal as a Chief Executive Officer of AlHuda Centre of Islamic Banking and Economics (CIBE) has been working consistently for last nine (9) years for poverty alleviation through Islamic Microfinance concept; he can be reached at zubair.mughal@alhudacibe.com ) |

| Old Press Releases |

Strategic Partners